Swiss National Bank decreased its stake in Teck Resources Ltd (NYSE:TCK) by 0.3% during the fourth quarter, according to its most recent filing with the Securities and Exchange Commission. The fund owned 2,499,879 shares of the company’s stock after selling 7,100 shares during the period. Swiss National Bank owned approximately 0.43% of Teck Resources worth $9,625,000 at the end of the most recent reporting period.

A number of other institutional investors have also added to or reduced their stakes in the company. Great West Life Assurance Co. Can increased its position in Teck Resources by 9.2% in the fourth quarter. Great West Life Assurance Co. Can now owns 3,234,232 shares of the company’s stock valued at $12,482,000 after buying an additional 273,237 shares during the period. Korea Investment CORP increased its position in Teck Resources by 6.4% in the fourth quarter. Korea Investment CORP now owns 612,700 shares of the company’s stock valued at $2,355,000 after buying an additional 36,900 shares during the period. Finally, Hexavest Inc. acquired a new position in Teck Resources during the fourth quarter valued at $1,895,000.

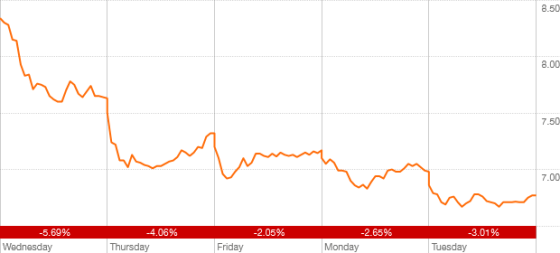

Teck Resources Ltd (NYSE:TCK) traded up 1.957% on Tuesday, reaching $8.595. The company’s stock had a trading volume of 4,951,063 shares. Teck Resources Ltd has a 52 week low of $2.56 and a 52 week high of $16.20. The stock’s 50 day moving average is $6.08 and its 200-day moving average is $5.14. The firm’s market capitalization is $4.95 billion.

Over the last five days, shares have gained 5.38% and 94.57% year to date. Shares have underperformed the S&P TSX by 36.99% during the last year. http://www.theglobeandmail.com March 23, 2016

Teck Resources (NYSE:TCK) last released its quarterly earnings data on Thursday, February 11th. The company reported $0.03 earnings per share (EPS) for the quarter, beating analysts’ consensus estimates of ($0.02) by $0.05. The firm had revenue of $2.14 billion for the quarter, compared to analyst estimates of $1.95 billion. During the same period in the previous year, the business posted $0.23 EPS. Teck Resources’s revenue for the quarter was down 5.4% on a year-over-year basis. Analysts predict that Teck Resources Ltd will post ($0.06) EPS for the current year.

Several equities analysts recently weighed in on TCK shares. Paradigm Capital upgraded Teck Resources from a “hold” rating to a “buy” rating in a research report on Sunday, February 14th. Zacks Investment Research upgraded Teck Resources from a “sell” rating to a “hold” rating in a research report on Thursday, February 18th. Scotiabank restated a “sector perform” rating and set a $8.00 price target (down from $8.50) on shares of Teck Resources in a research note on Tuesday, February 16th. Canaccord Genuity lowered Teck Resources from a “hold” rating to a “sell” rating in a research note on Thursday, December 17th. Finally, Nomura dropped their price target on Teck Resources from $6.40 to $4.25 in a research note on Friday, January 8th. Five equities research analysts have rated the stock with a sell rating, eleven have given a hold rating and six have issued a buy rating to the stock. Teck Resources currently has a consensus rating of “Hold” and an average target price of $9.47.

Teck Resources Ltd. is engaged in the business of exploring, acquiring, developing and producing natural resources. The Company is focused on steelmaking coal, copper, zinc and energy. The Company exports seaborne steelmaking coal and produces mined zinc. The Company also produces lead, molybdenum, silver, and various specialty and other metals, chemicals and fertilizers.

Source: Teck Resources Ltd (TCK) Stake Reduced by Swiss National Bank – Financial Market News