Get the report

Economic and Fiscal Outlook – April 2016

Get the data

EFO April 2016 – Figures.xlsx

Summary

This report responds to the 4 February 2016 Standing Committee on Finance motion. It incorporates data available up to and including 12 April 2016.

Since the Parliamentary Budget Officer’s November 2015 report, the outlook for the global economy has deteriorated further. Expectations of the future path of prices for key commodities have also been revised lower.

Despite this weaker external outlook, PBO anticipates that the combination of fiscal measures in Budget 2016 and accommodative monetary policy will help bolster the Canadian economy.

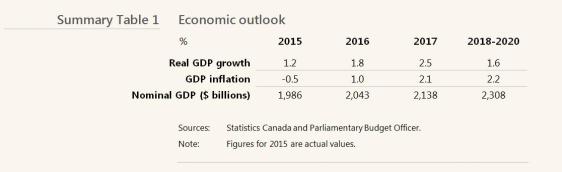

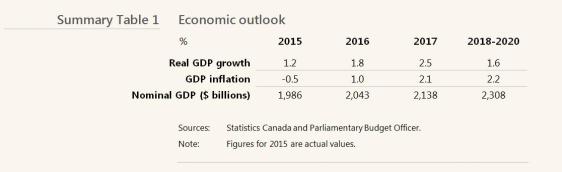

PBO projects that growth in real gross domestic product (GDP) will rebound to 1.8 per cent in 2016 and then rise to 2.5 per cent in 2017. Economic growth is then expected to moderate over 2018 to 2020, reflecting the tapering of fiscal measures and the normalization of monetary policy.

The level of nominal GDP—the broadest single measure of the tax base—is projected to be almost $20 billion lower each year, on average, between 2016 and 2020 compared to our November report.

However, relative to the Government’s planning assumption for nominal GDP in Budget 2016 our projection is, on average, $40 billion higher per year over 2016 to 2020. The difference is most pronounced in 2016 and 2017, reaching close to $50 billion in those years.

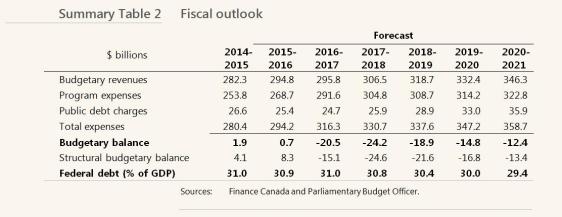

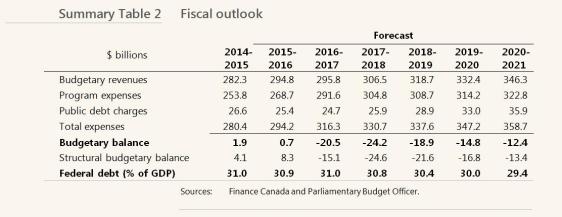

PBO’s November 2015 fiscal outlook provided an independent status quo planning assumption for the start of the 42nd Parliament. We have updated our fiscal outlook to include measures announced in Budget 2016 as well as measures announced prior to the budget.

PBO estimates there was a small surplus in 2015-16. We expect a budgetary deficit of $20.5 billion in 2016-17, which is mostly attributable to $13.2 billion of new measures since the Fall Update. The deficit is then projected to rise to $24.2 billion in 2017-18 as the result of moving to the 7-year breakeven mechanism for Employment Insurance premium rates (a 15 per cent reduction in contributions) and a $7.5 billion increase in direct program expenses.

We project the deficit to decline to $12.4 billion over 2018-19 to 2020-21 based on the Government’s forecast that direct program expenses (DPE)—in particular the operating costs of departments—will remain flat over the period 2017-18 to 2019-20.

PBO’s forecast of the budgetary deficit is $4.5 billion lower, on average, than Budget 2016 over the projection horizon. The average difference is roughly in line with the Budget 2016 forecast adjustment, which removed $40 billion from GDP (equivalent to $6 billion in revenues) in each year of the Government’s planning horizon.