by Norman Farrell September 19, 2016

BC Hydro has three particularly important types of customers. These consumers, all inside British Columbia, are categorized as:

- Residential,

- Commercial and light industry,

- Heavy industry.

There are others outside the province but BC power users shouldn’t be subsidizing their needs by delivering electricity at a fraction of today’s marginal cost.

In the past year, the utility began reporting certain sales outside BC as if these were domestic consumption. BC Hydro wants to show a greater need for power to rationalize increased IPP purchases and addition of generating facilities.

It is manipulation intended to hide BC Hydro’s growing surplus of power. It makes no sense to add yet more capacity or purchase power at high prices if it is to be dumped outside British Columbia for a fraction of what new power costs.

That is precisely what happens because BC Hydro’s three types of domestic customers bought the same quantity of power in fiscal year 2016 as they did in fiscal year 2005.

However, IPP purchases in 2016 were 222% more by volume and 312% more by dollar value than in 2005. That means 835 million additional dollars went from the pockets of ratepayers to the accounts of private power producers, most of whom are not owned by British Columbians.

In addition to throwing billions at IPPs, BC Hydro has been spending money like a drunken lottery winner. And, we know where they get the cash that’s being thrown around. What isn’t being taken through higher electricity rates is borrowed, to be recovered by even larger price rises.

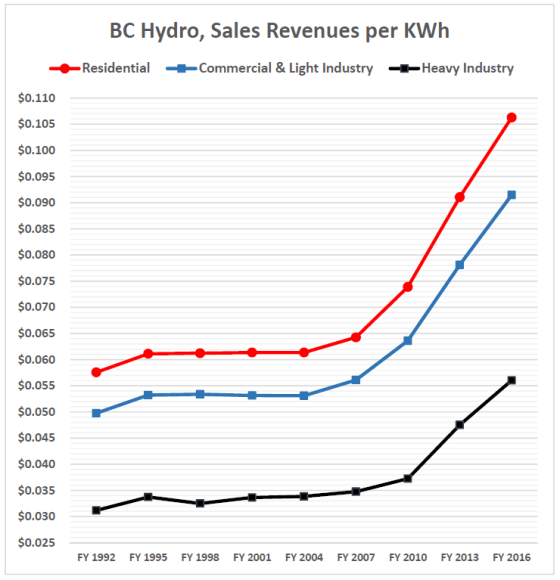

We had ten years without power rate increases (1993 to 2003), then years of modest increases (2004 to 2010). However, in 2011, Christy Clark returned. Although Premier Gordon Campbell set the stage and began doing the dirty deals, Clark’s Government avoided every opportunity to avoid or moderate the losses.

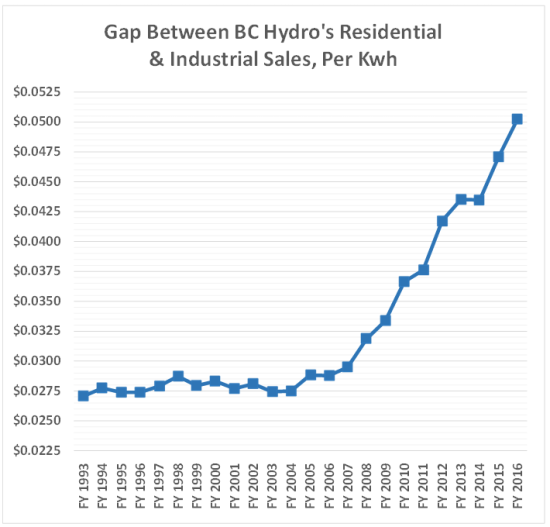

In addition, they spun out yet more benefits for their special friends, particularly big contributors in the resource industries. Here is a look at electricity prices over 25 years. Obviously, residential users carry the largest burden.

Source: 2005→2016 IPP purchases ↑↑ $835m