28 June 2016

Get the report

Fiscal Sustainability Report 2016.pdf

Get the data

FSR 2016 – Figures.xlsx

Summary

Medium-term budget plans are insufficient to evaluate the long-term prospects for public debt under current fiscal policy. This report extends PBO’s medium-term analysis to assess the fiscal sustainability of Canada’s federal government, subnational governments and public pension plans.

Fiscal sustainability means that government debt does not grow continuously as a share of the economy. The goal is to identify if policy changes are required to avoid unsustainable public debt accumulation, after considering the economic and fiscal impacts of population ageing.

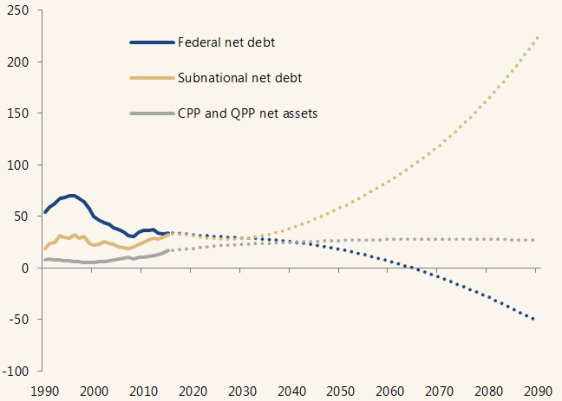

Government sector net debt over the long term

% of GDP

Sources: Statistics Canada and Parliamentary Budget Officer.

Federal government

PBO’s 2015 Fiscal Sustainability Report concluded that the federal government had room to increase spending or reduce taxes. Measures in Budget 2016 have reduced this room. However, the government continues to have flexibility to expand policy while maintaining fiscal sustainability.

To maintain net debt at its current level of 33.7 per cent of gross domestic product (GDP) over the long term, PBO estimates that the federal government could permanently increase spending or reduce taxes by 0.9 per cent of GDP ($19.2 billion in current dollars). This is down from 1.4 per cent in last year’s assessment.

PBO’s federal sustainability assessment concludes:

- Federal fiscal room has been reduced as a result of reversing the increase in the age of eligibility for the Old Age Security program. The higher long-run cost as a result of the change is expected to reduce federal fiscal room by 0.2 per cent of GDP.

- Removing existing children’s benefits and introducing the Canada Child Benefit are expected to reduce fiscal room by 0.1 per cent of GDP. However, a complete picture of the impact is uncertain, as no details have been announced describing the indexation of benefits or eligibility thresholds beyond the medium term. Parliamentarians may wish to seek further clarification.

- The impact of other Budget 2016 spending measures, including Phase 1 and Phase 2 of Canada’s New Infrastructure Plan, is 0.1 per cent of GDP.

Subnational governments

The outlook for subnational governments (that is, combined provincial, territorial, local and Aboriginal governments) is little changed from last year’s assessment. Permanent policy actions amounting to 1.5 per cent of GDP ($30.2 billion in current dollars) would be required to stabilize the subnational government net debt-to-GDP ratio at its current level (32.5 per cent) over the long term. The required fiscal consolidation has increased marginally from 1.4 per cent in last year’s assessment.

PBO’s subnational government sustainability assessment concludes:

- The slight increase in the fiscal gap is the result of higher-than-projected program spending in 2015.

- Health care spending outpaced nominal GDP growth in 2015. This, along with historical revisions to the national accounts, has raised PBO’s projection for excess cost growth. Excess cost growth refers to the increase in health spending that cannot be accounted for by general inflation, real per capita income growth, population growth and ageing.

- Although provinces cannot meet the challenges of population ageing under current policy, the required fiscal consolidation is not insurmountable if compared to previous consolidation episodes. Furthermore, the changes do not need to occur immediately. However, the longer they are delayed, the greater the adjustment that is required.

Canada Pension Plan and Quebec Pension Plan

The fiscal gap for the public pension sector represents the immediate and permanent change in contributions and/or expenses that returns the net asset-to-GDP ratio to its current level over the long term. PBO estimates that public pension plans are sustainable over the long term.

The long-term projection of the Canada Pension Plan (CPP) does not incorporate the agreement in principle signed by Canada’s Finance Ministers on 20 June 2016. PBO will assess the changes to the CPP when further details on implementation are released.

Total general government sector

The total general government sector in Canada (that is, the combined federal and subnational governments and public pension plans) is not fiscally sustainable without permanent increases in revenues or reductions of at least 0.6 percentage points of GDP.

Changes could be made at any level of government to eliminate the total government fiscal gap. However, ensuring the sustainability of each government sector on its own would require a consolidation at the subnational level and/or higher transfers from the federal government.

Related posts

-

21 July 2015

This report provides an assessment of the long-term sustainability of government finances for three government sub-sectors: the federal government; subnational governments consisting of provinces, territories, local, and aboriginal governments; and, the Canada and Quebec Pension Plans. [PDF]