March 22, 2016 – Ottawa, Ontario – Department of Finance

The Minister of Finance, Bill Morneau, today tabled the new Government of Canada’s first federal budget, Growing the Middle Class, a plan that takes important steps to revitalize the Canadian economy, and delivers real change for the middle class and those working hard to join it.

A strong economy starts with a strong middle class. That is why building an economy that works for Canadians and their families is the top priority of this government.

Budget 2016 offers immediate help to those who need it most, and lays the groundwork for long-term economic growth. Most importantly, it focuses squarely on people and the things that matter most to them—things like strengthening the middle class, creating jobs, and growing the economy.

As of January 1st, the government’s Middle Class Tax Cut ensures roughly 9 million Canadians receive a bigger paycheque every payday.

Today, Minister Morneau builds on this progress with the introduction of the new Canada Child Benefit—a simpler, tax-free, more generous, targeted benefit that helps those who need it most: the middle class. Starting in July of 2016, nine out of ten families will receive more money than they did under the previous government.

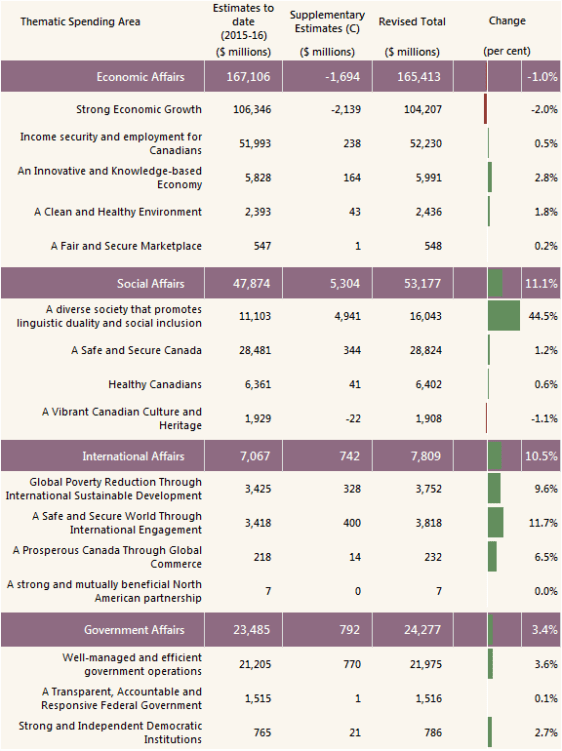

Budget 2016 signals a new approach that will create jobs and improve the quality of life for Canadians, today and in the future. This includes historic new investments in infrastructure that total more than $120 billion over the next decade.

As an immediate first step, the government will invest $11.9 billion in modern and reliable public transit, water and wastewater systems, affordable housing, and in retrofits and repairs to protect existing projects from the effects of climate change.

Additional longer-term investments will help Canada become a low carbon economy, and create more vibrant cities, digitally connected rural areas, and safe, healthy, thriving communities.

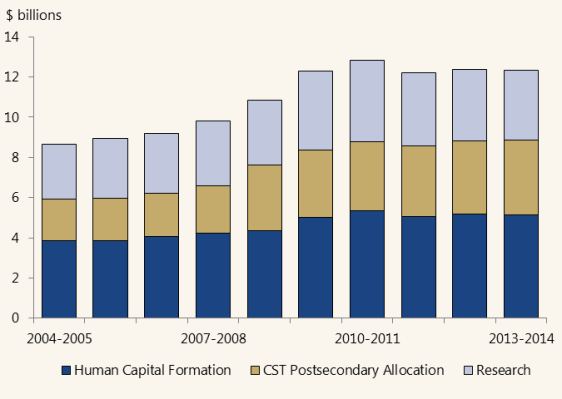

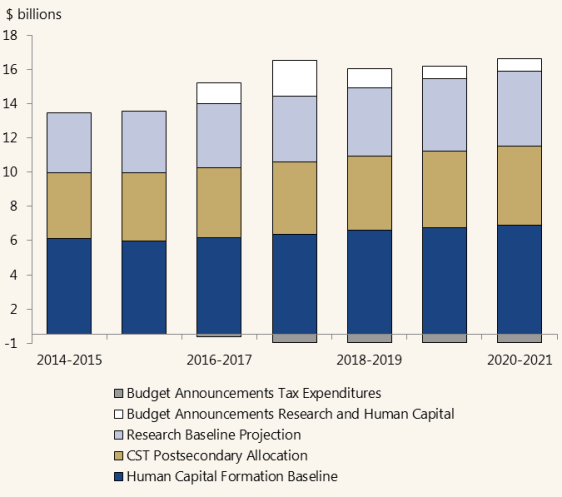

Budget 2016 also provides significant new investments to support both students and post-secondary institutions, so that the next generation of Canadians is well-equipped to tackle the challenges of the future. In addition, the government will promote research, accelerate business growth, and support clean technology to better position Canada in the rapidly shifting global economy.

Recognizing that protecting the environment and growing the economy go hand in hand, the government will invest in clean technologies that address climate change, air quality, clean water, and clean soil. Budget 2016 also reiterates the government’s intention to establish a $2 billion Low Carbon Economy Fund.

To ensure that this growth is shared by all Canadians, Budget 2016 takes renewed steps to give all Canadians the same opportunities to succeed, no matter who they are, or where they come from. This includes unprecedented investments in First Nations, Inuit Peoples, and the Métis Nation—totalling $8.4 billion over five years—in areas that include education, infrastructure, and skills training. The government will ensure access to clean drinking water for every child, including those who live on reserves.

Investments in a more inclusive and fair Canada include efforts to: provide federal leadership in health care; help seniors realize the promise of a dignified and secure retirement; renew a commitment to enhance the Canada Pension Plan; and fulfill our sacred obligation to Canada’s veterans.

Budget 2016 also takes action to renew Canada’s place on the world stage. The government will provide international assistance for the most vulnerable, and welcome as many as 300,000 permanent residents in 2016 to foster sustainable growth and grow the middle class.

Growing the Middle Class comes at a time when the Government of Canada has both the capacity and the willingness to act. Budget 2016 takes action to revitalize the economy and create opportunity for all Canadians, by focusing on the middle class and those working hard to join it.

Quote

“Our plan will recapture the hope and optimism for the future that existed in previous generations, and put it to work for the next. Real change is not just about today or tomorrow. It is about revitalizing the economy in the years and decades to come, so that it works for the middle class and helps those working hard to join it.”

– Bill Morneau, Minister of Finance

Related

Source: Budget 2016