Bloomberg Nanos Weekly Consumer Confidence Tracking

The Bloomberg Nanos Canadian Confidence Index hit a new high for 2016 largely on positive sentiment related to real estate.

“The bullish sentiment on the value of real estate continues in the Bloomberg Nanos tracking,” said Nanos Research Group Chairman Nik Nanos. “Positive views on the value of interest hit a level not seen since July 2014.

“To the extent that consumer sentiment is signaling a housing bubble, the monetary authorities might need to balance the necessity of extremely low interest rates during the economy’s period of adjustment with policies that tighten the availability of household credit and dampen the domestic demand for housing”, said Bloomberg economist Robert Lawrie.

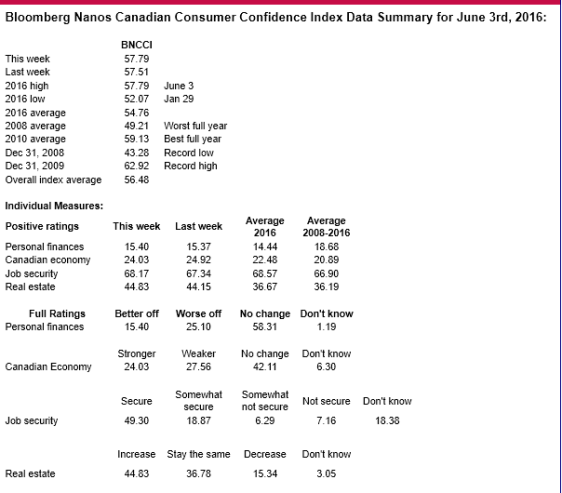

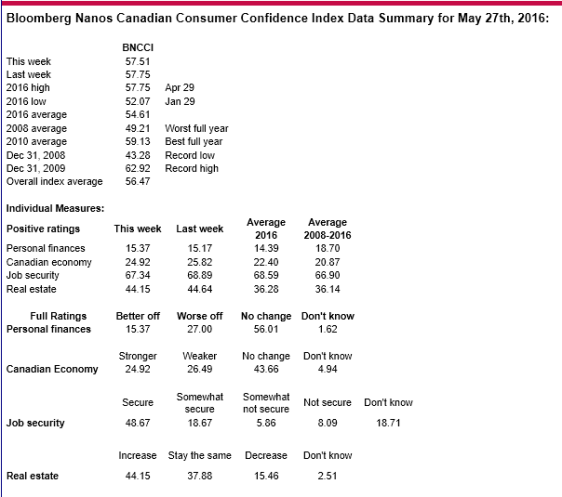

The BNCCI, a composite of a weekly measure of financial health and economic expectations, registered at 57.79 compared with last week’s 57.51. The twelve month high stands at 58.62.

The Bloomberg Nanos Pocketbook Index is based on survey responses to questions on personal finances and job security. This sub-indice was at 58.08 this week compared to 58.23 the previous week. The Bloomberg Nanos Expectations Index, based on surveys for the outlook for the economy and real estate prices, was at 56.49 this week (compared to 56.78 last week).

The average for the BNCCI since 2008 has been 56.48 with a low of 43.28 in December 2008 and a high of 62.92 in December 2009. The index has averaged 54.76 this year.

To view the weekly tracking visit our website.

Methodology

The BNCCI is produced by the Nanos Research Corporation, headquartered in Canada, which operates in Canada and the United States. The data is based on random telephone interviews with 1,000 Canadian consumers (land- and cell-lines), using a four week rolling average of 250 respondents each week, 18 years of age and over. The random sample of 1,000 respondents may be weighted by age and gender using the latest census information for Canada and the sample is geographically stratified to be representative of Canada. The interviews are compiled into a four week rolling average of 1,000 interviews where each week, the oldest group of 250 interviews is dropped and a new group of 250 interviews is added. The views of 1,000 respondents are compiled into a diffusion index from 0 to 100. A score of 50 on the diffusion index indicates that positive and negative views are a wash while scores above 50 suggest net positive views, while those below 50 suggest net negative views in terms of the economic mood of Canadians.

A random telephone survey of 1,000 consumers in Canada is accurate 3.1 percentage points, plus or minus, 19 times out of 20.

All references or use of this data must cite Bloomberg Nanos as the source.