Reuters Last updated Tuesday, Jan. 05, 2016 4:07PM EST

Global equity markets were flat on Tuesday after their worst January kick-off in years as concerns about the global economy weighed on sentiment and pushed traders to seek the relative safety of the low-risk yen.

Crude prices fell on concerns about the pace of growth in China, the world’s second-largest oil consumer. News that Chinese rail freight volumes logged their biggest-ever annual decline in 2015 added to economic growth worries.

The Standard & Poor’s/TSX Composite Index finished down 7.01 points, or 0.05 per cent, to 12,920.14 in Toronto. The Canadian benchmark index sank 11 per cent in 2015, the biggest annual slide since 2008 as a combination of slowing growth in China, a glut in crude production, and the prospect of increasing U.S. lending rates weighed on the nation’s stocks.

Global equities fluctuated with government funds propping up Chinese share prices Tuesday after a market rout. A 7-per-cent drop in the CSI 300 Index Monday halted trading in China’s first day with circuit breakers after disappointing manufacturing data fueled concern the world’s second-largest economy was faltering further.

Valeant Pharmaceuticals International Inc. rose 2.8 per cent. Shares had lost 3.2 per cent in the last two trading sessions after a regulatory filing on Thursday showed Bill Ackman, the activist investor who has been a staunch defender of Valeant, trimmed his fund’s holdings of the stock for tax reasons. Ackman’s Pershing Square Capital Management sold about 5 million shares of Valeant in order to create a tax loss for investors in two accounts.

Shares of Progressive Waste Solutions advanced 7.3 per cent after the waste management company said it was exploring strategic options.

The most influential weights included fertilizer producer Potash Corp, which declined 2.4 per cent, and FirstService Corp., which was down 5.3 per cent..

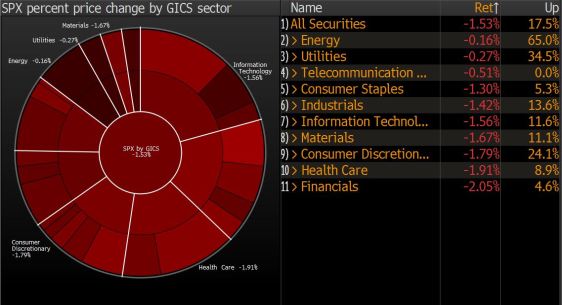

In New York, the Standard & Poor’s 500 Index rose 0.2 per cent to 2,016.86, after wavering between gains and losses following the gauge’s 1.5-per-cent drop on Monday.

The Dow Jones industrial average rose 10.07 points, or 0.06 per cent, to 17,159.01, while the Nasdaq Composite dropped 11.66 points, or 0.24 per cent, to 4,891.43.

“What people are looking at are the big three — global growth, especially Chinese growth, the impact of energy and a Fed that’s now in play,” said Stephen Wood, who helps manage $237-billion as chief market strategist for North America at Russell Investments in New York. “Oil is going to continue to be a volatile factor, not only in the broader market but also earnings.”

Even as Monday ranked as the sixth-worst start to a year for the S&P 500 since 1932, the move is less surprising when compared with how the gauge usually fares. The index has moved an average 1.1 per cent in either direction on opening day, compared with an average daily move of 0.77 per cent on all other days.

Following Monday’s rout, investors stuck with what worked last year. Health-care and consumer staples shares, two of 2015’s best performers, were among the leaders. Technology shares slipped the most under Apple’s drag. Seven of the S&P 500’s 10 main industries were higher, with phone companies posting the strongest advance.

“Overall, yesterday wasn’t too bad and may have even been an overreaction,” said Mark Kepner, an equity trader at Themis Trading LLC in Chatham, NJ. “We’ve been through this before with China — they’re in the process of changing their economy, you’re going to have ups and downs with that and it’s going to keep happening.”

The benchmark slipped 0.7 per cent in 2015 to cap its first annual drop since 2011, after reaching a record in May and suffering its first correction in four years in August amid concerns that China’s slowdown will crimp global growth.

Sentiment has turned more cautious on stocks amid the Federal Reserve’s first interest-rate increase since 2006, and forecasts for little to no growth in corporate earnings before the spring. Strategists at Citigroup Inc. cut their view on U.S. equities to underweight Tuesday, saying that while they’re not especially bearish, they see better opportunities in Europe and Japan. “After outperforming for six consecutive years, maybe U.S. equities are due a breather,” the firm wrote in a note.

Fed officials expect the pace of future rate increases to be gradual, though they have stressed that the path depends on progress in economic data. A report Monday showed the fastest contraction in U.S. manufacturing in six years, adding to worries that weakness in China’s economy is spreading. Investors will look for further clues this week in data on services industry growth, factory activity, employment and minutes from the Fed’s December meeting.

A rally in mining and telecom stocks helped European shares to edge slightly higher in volatile trade..

MSCI’s all-country world stock index rose 0.06 per cent and its emerging markets index rose 0.02 per cent.

“The main reason for the uncertainty is China, given that company numbers and the macroeconomic picture in Europe and the U.S. have not changed,” said Alessandro Allegri, chief executive of Italian asset manager Ambrosetti Asset Management.

In Europe, the pan-regional FTSEurofirst 300 index rose 0.66 per cent to 1,410.37. The heavyweight German index DAX gained 0.3 per cent.

Oil dropped to a two-week low on speculation that a government report will show U.S. crude inventories climbed last week.

Futures tumbled 2.1 per cent in New York. Stockpiles probably rose the 13th time in 15 weeks, keeping them more than 130 million barrels above the five-year average, a Bloomberg survey showed. The American Petroleum Institute will release its weekly data today while the Energy Information Administration will report on Wednesday. Supplies at Cushing, Okla., the biggest U.S. storage hub, climbed to a record last month, according to the EIA.

“We’re under pressure because both the API and EIA might show Cushing supplies rose from what was already an all-time high,” said Bob Yawger, director of the futures division at Mizuho Securities USA in New York. “Nationwide, supplies probably rose last week, narrowing the gap on the all-time record.”

Oil capped the biggest two-year loss on record in 2015 as the Organization of Petroleum Exporting Countries effectively abandoned production limits amid a global supply glut. Investors are assessing the impact of Saudi Arabia’s move to cut ties with Iran, while also watching measures by China to prevent the country’s financial-market volatility from weighing on a slowing economy.

West Texas Intermediate for February delivery fell 79 cents to settle at $35.97 a barrel on the New York Mercantile Exchange. It was the lowest close since Dec. 21. Prices slid 30 per cent last year.

Brent for February settlement declined 80 cents, or 2.1 per cent, to $36.42 a barrel on the London-based ICE Futures Europe exchange. The European benchmark crude closed at 45 cent premium to WTI.

On Sunday, Saudi Foreign Minister Adel al-Jubeir gave Iran’s ambassador 48 hours to leave Riyadh following an attack on the Saudi embassy in Tehran by demonstrators protesting the execution of a Shiite cleric. Bahrain also severed diplomatic relations with Iran, while the United Arab Emirates reduced its diplomatic representation and Kuwait recalled its ambassador.

While moves to isolate Iran raise the specter of deepening conflicts in the Middle East, the impact on oil prices is limited because of the global surplus, according to Macquarie Group Ltd. and FGE, an industry consultant. Citigroup Inc. described the tensions as “indeterminate” for oil markets in the near term, saying there’s less chance that the Saudis will cut crude output ahead of Iran’s return to the market following the removal of international sanctions.

With files from Bloomberg News

As losses snowballed in U.S. stocks around midday, the best thing U.S. bulls had to say about the worst start to a year since 2001 was that there are 248 more trading days to make it up.

As losses snowballed in U.S. stocks around midday, the best thing U.S. bulls had to say about the worst start to a year since 2001 was that there are 248 more trading days to make it up.